Find out what documentation is required to hire a motorcycle loan.

Adverts

The motorcycle is a means of transport widely used throughout Brazil. It is practical, economical and very versatile for both cities and rural areas. Therefore, motorcycle financing ends up being a purchase option for many people.

Having a motorcycle makes the day to day of people who own it easier, another important point that brings advantages over owning a car is the economy of it. We can say that fuel economy, for example, while an economy car runs an average of 10 km with 1 liter of fuel, a 150-cylinder motorcycle is capable of running more than 30 km.

Adverts

Adverts

Let's talk below about the documentation needed to carry out a motorcycle financing.

Required Documentation

1- Copy of RG/CPF

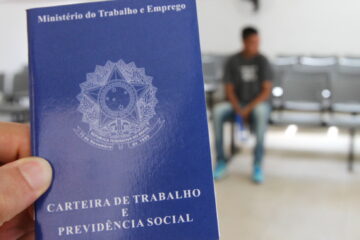

2- Work Card

Would you lend money to someone who doesn't have an income? Yeah, neither do banks and finance companies. So you need to prove income, and this is usually done with the Work Card. Remember, you need at least three months of formal employment to have your credit approved! Some institutions also accept the history of your bank transactions for the last few months, in case you work as a freelancer/informal.

3- Proof of residence

And there's no use arguing, the money belongs to the bank and he chooses the rules, so follow the rules of the game. If you don't have any account in your name, talk to those who live with you to transfer the energy bill to your name, so you won't have any problems with this document.

Veja mais conteúdo como este em nossa página Jornal Na Net.